Did you know … the practice of collecting property taxes dates back to ancient Egypt, Persia and China, where taxes were collected from farmers based on projected crop yield? William the Conqueror continued the practice in England during the Middle Ages, where Lady Godiva rode her horse while naked through town in protest.

Property values have skyrocketed throughout Summit and Wasatch counties, which could warrant an increase in your tax bill this year, but we don’t recommend taking the Lady Godiva approach to contesting your property tax notice, which should have arrived within the past few weeks. If you haven’t received your notice yet, you can find out how to connect with the Summit County Assessor’s Office by clicking here, or the Wasatch County Assessor’s Office here.

Although Utah’s property tax rate is ranked 12th lowest in the U.S. and is considered to be one of the 10 best states for property taxes, any increase to a monthly budget can put a pinch on some households and businesses already saddled with increasing costs for fuel and other goods. While we know the benefit property taxes provide to the community via public services such as schools, parks, fire, and police protection, it’s always wise to ensure you’re not paying more than your fair share.

Utah’s property taxes vary depending on whether a property is a primary or secondary residence. That’s why it’s important to pay attention to the notice to ensure your property is categorized properly.

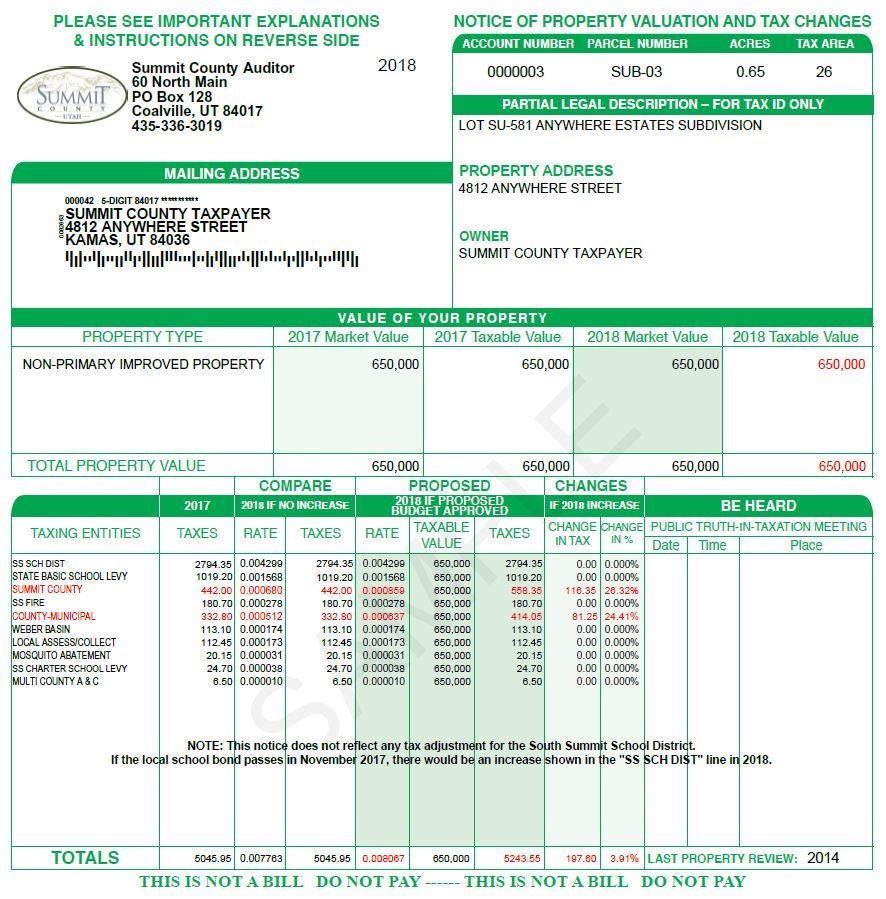

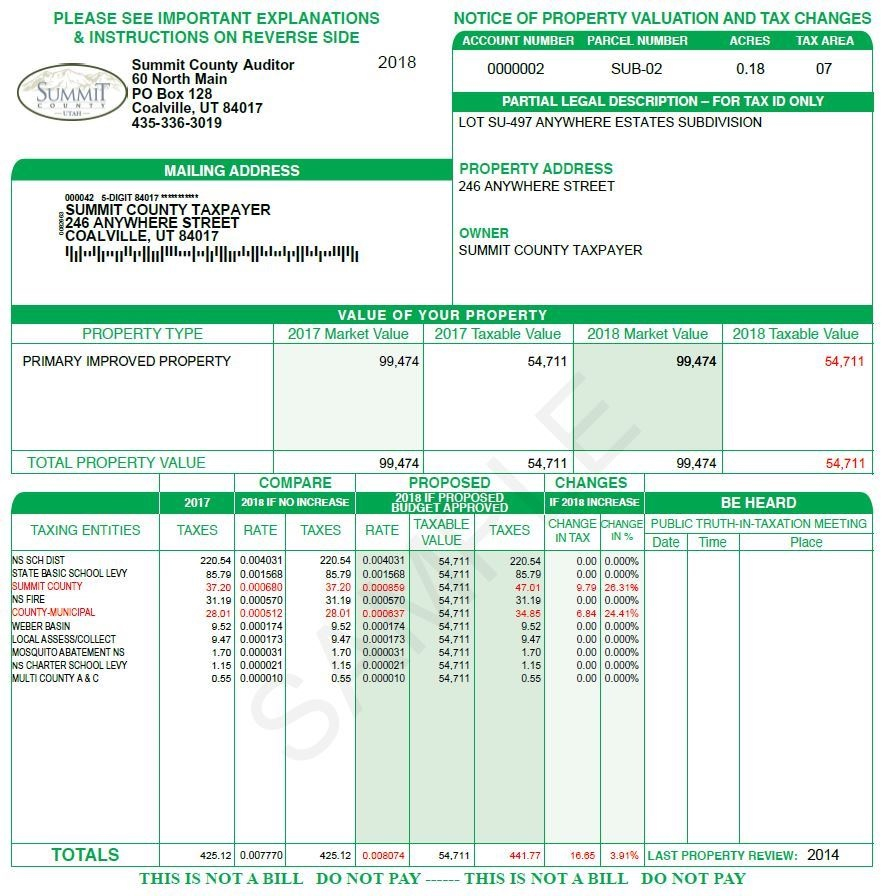

Below, you’ll find two property tax notices from Summit County: One for a primary residence and one for a secondary residence. Secondary residences are taxed at the full assessed value, while primary residences are taxed at 55% of assessed value:

If your notice shows taxes based on 100% and you live in the home full-time, or rent out the property full-time (but do not rent it nightly for 14 or more nights each year), then you should fill out the Signed Statement of Primary Residence and file it with the Assessor’s office before September 15th. Signed statements received after September 15th will be considered in the following year. Visit the Summit County Assessor site by clicking here, or the Wasatch County Assessor site here, to learn more about residency exemptions. Depending on the value of your property, you could save thousands of dollars.

Another way to save money on property taxes is to appeal your assessed value. The assessed value of your property is determined by the assessor’s office based on the prevailing local real estate market conditions

If you think the amount on your notice is unreasonable, I can work with you to help determine whether the assessed value is fair. The National Taxpayers Union Foundation recommends the following steps in appealing your assessment:

❏ Make sure all deductions to which you are entitled were granted

❏ Determine any deadlines or legal requirements for filing the appeal or for claiming any deductions. Comply with the legal requirements and don’t miss these deadlines!

❏ Check the accuracy of the assessor’s math, description of your property, work papers, and record card for your property.

❏ Consult with any experts who might be of assistance (see my notes on this below)

❏ Locate at least five comparable properties (with my help)

❏ Make adjustments for differences between your property and comparables

❏ Check your property’s assessment against the assessments of the comparables

❏ If your assessment is unfair, make an informal appeal to the assessor first. If the assessor doesn’t agree, file your appeal.

❏ Attend an appeals board hearing to get a feel for the process.

❏ Prepare a written summary of your case and rehearse your presentation.

Prepare Your Appeal

You must file your appeal within 45 days of receiving your property tax notice. For Summit County, this can be accomplished by either submitting an electronic Board of Equalization Appeal Form via the county’s online portal or downloading a PDF version to fill out and send to the Summit County Board of Equalization.

The Wasatch County primary residence exemption form can be found by clicking here.

You must include a copy of your property tax notice, along with any evidence, such as an appraisal, sales comparable to your property or MLS – Multiple Listing Services – data to support your appeal. Contact me if you would like help with this.Decisions depend on the availability and workload of Board of Equalization Appeal Officers, and could take several weeks. Once a decision is reached, you can expect to receive a “Notice of Determination.” If your appeal is denied, you cannot appeal your final property tax bill when it is received in November. To contact the Summit County Assessor’s Office, call 435-336-3257, or visit them at the county courthouse in Coalville, at 60 North Main Street. The Assessor can be emailed at slarsen@summitcounty.org.For Wasatch County, call 435-654-3221, or visit them at 25 North Main Street in Heber.If you have any questions or need help finding comparable properties to support your appeal, please reach out to me sooner than later. I’m happy to walk you through the art of how to appeal your property taxes anytime, but keep the September deadline in mind!

More people than ever have decided to Choose Park City, and have made Summit or Wasatch counties their permanent home. Connect with Christine Grenney at 435-640-4238, or visiting her website by clicking here to learn more about the benefits of moving to the Wasatch Back!